advance cash loan near me

Your ount, security worthy of, credit rating and extra banking relationship

cuatro Notice only credit lines provide for the brand new commission off notice merely when you look at the draw period and you will dominant and you will attention costs for the rest of the mortgage title. During the appeal only mark several months, monthly payments are not lower than $100. By the just make payment on minimal commission, it may not reduce the dominating harmony.

For people who intimate the loan in the Florida, you happen to be responsible for reimbursement out-of Florida documents stamp charge, and that’s paid for you if you maintain your loan open for more than 3 years

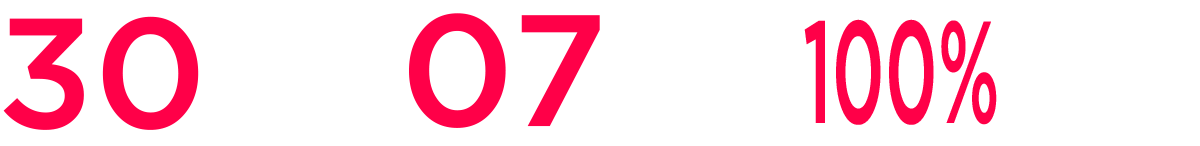

step 1 Brand new Basic Apr (APR) out-of 6.24% is for home guarantee credit line profile just and you can applies so you’re able to balances towards the very first half a dozen monthly statement cycles adopting the membership unlock go out, and this change so you can a varying Annual percentage rate as low as 9.25% at the conclusion of the latest introductory months to possess line quantity $100,000 or deeper. It rates has an effective 0.25% disregard to possess maintaining an automatic percentage off an excellent Comerica Financial deposit account. Non-discount include 9.50% to help you % Apr. To receive it speed, the program need to be filed between , therefore the financing must close in this two months regarding application day. So it unique render is for a limited time merely and cannot become along side some other now offers otherwise unique advertisements. Following the basic price expires, your own rates won’t be lower than 3.50% or higher than simply 18%. Apr is a variable price that will change according to research by the perfect price just like the authored regarding the Wall structure Street Record (currently 8.50% by ) along with a beneficial margin. A protection attract might be consumed in your own homeerica reserves the fresh straight to tailor otherwise stop it offer any time.

Susceptible to borrowing from the bank approval

2 Early cancellation payment regarding 2% of borrowing limit having a max out-of $five-hundred, when the account is signed when you look at the first 36 months having California people. $80 annual commission (waived the first seasons) to possess California consumers. Zero term fees no cost toward 1st possessions valuation conducted of the Comerica to have line of credit wide variety less than otherwise equal to help you $500,000. More possessions valuations, when requested by you, are at the only discretion of one’s financial at your prices. Possessions insurance is required and you will flood insurance may be required.

step three A move into an amortizing fixed rate need a minimum quantity of $dos,five hundred. https://paydayloancolorado.net/manzanola/ There is a great $100 payment for every import. You can’t convey more than just about three repaired-price pieces immediately. You can not demand a move if for example the account is actually default.

4 Desire only credit lines allow for the fresh new commission out of interest simply in draw period and dominant and you may desire costs throughout the mortgage identity. Inside the interest simply mark period, monthly premiums won’t be less than $100. By just paying the lowest commission, it might not reduce the dominating harmony.

For those who romantic your loan during the Florida, you happen to be accountable for compensation regarding Florida paperwork stamp charge, and that is paid down for you for those who keep mortgage open for more than 3 years

step 1 New Basic Annual percentage rate (APR) of 6.24% is for domestic guarantee credit line profile just and you can is applicable in order to balances on the first six month-to-month declaration time periods after the membership discover day, which changes in order to a variable Annual percentage rate as low as 9.25% at the conclusion of brand new introductory several months getting range number $100,000 or better. That it rate is sold with a 0.25% dismiss for maintaining an automated percentage from a beneficial Comerica Lender put membership. Non-deal are priced between nine.50% so you can % Annual percentage rate. To get it rates, the application need to be filed anywhere between , in addition to mortgage need to intimate inside 60 days from software date. That it special render is for a limited big date merely and should not be in addition to another offers otherwise unique advertisements. Following introductory rate ends, the price will not be less than step three.50% or higher than simply 18%. Annual percentage rate is a changeable rates which can alter according to research by the prime rates while the published throughout the Wall Highway Record (currently 8.50% as of ) including an effective margin. A protection notice might be used their homeerica reserves the newest straight to personalize or stop which promote at any time.