FinTech

Direct-Access Broker: What It Means, How It Works, Example

Content

- Best DMA Brokers (Direct Market Access) Compared & Reviewed

- Risk Management and Control with DMA

- The Benefits of DMA for Traders

- Who should use a direct access broker?

- Top 5 Direct Market Access Brokers – liquidity 24

- Can you trade forex CFD derivatives with a direct market access broker?

- What’s the difference between low latency and ultra-low latency direct market access?

By accessing multiple liquidity sources, traders can achieve better pricing and faster order execution. A traditional broker is a type of broker that acts as an intermediary between https://www.xcritical.com/ the client and the market. This means that the broker executes orders on behalf of the client and charges a commission for each trade.

Best DMA Brokers (Direct Market Access) Compared & Reviewed

These brokers can provide you with real-time trading through an electronic system or provide you with direct access to exchanges. Not only do you get speed and efficiency, but you’ll also be able to take advantage of your broker’s quotes and charts. But, make sure you look at the fee structure before you commit direct market access providers to a broker to ensure that you’re getting the most bang for your buck.

Risk Management and Control with DMA

Since they ‘make the market’ for the security, they are therefore often referred to as market markers. Today, traders can trade securities by placing orders directly on the order books of stock exchanges and electronic communication network brokers (ECNs) through direct market access (DMA trading). In conclusion, DMA has revolutionized the trading landscape, empowering traders with direct access to liquidity providers and enhancing their trading capabilities.

The Benefits of DMA for Traders

Direct market access (DMA) provides access to more liquidity, allows you to view market depth and use advanced execution. If you are a long-term investor, you can use any type of broker because your trade will be executed near the range where you want. For example, if Apple shares are trading at $130, you can be sure that it will be executed near that range. Therefore, it won’t make a significant difference since your plan is to hold it for a long time. In a retail account, you will likely not pay any fees since most brokers have removed commissions. Algorithmic trading, also known as Algo, on the other hand, is the use of algorithms to execute trades.

Who should use a direct access broker?

Equities, commodities, futures, foreign exchange and other tradable securities within the financial markets are bought and sold on an exchange, which is often referred to as an organised market. Liquidity providers are entities that hold a large quantity of a financial product. They provide financing for the security and then facilitate its trading in the direct market.

Top 5 Direct Market Access Brokers – liquidity 24

You can trade with direct market access (DMA) via IG’s web-based trading platform and L2 Dealer platform by speaking to one of our consultants over the phone. As markets become more efficient with technology enhancements, there is a greater need for quicker trade execution. That’s because more retail investors are accessing the marketplace with their smartphones rather than using a desktop or voice-directed trades with a human. These brokers are also popular with day traders because they offer other services like streaming quotes, interactive charts, and Level II Nasdaq quotes among others. These brokers cut down their costs and boosted their efficiency by eliminating the role of the third party, which allows them to charge a lower commission than traditional brokers. If a buy-side firm does not have direct market access, then it must partner with a sell-side firm, brokerage, or bank with direct market access to determine a trading price and execute the final transaction.

Can you trade forex CFD derivatives with a direct market access broker?

Since ECN brokers aggregate prices from multiple liquidity providers, traders can benefit from highly competitive spreads, ensuring cost-effective trading. Additionally, ECN brokers often provide traders with access to Level 2 market depth data, allowing them to see the order book and make more informed trading decisions. Whilst many firms have undertaken in-house development projects to deploy direct access to trading venues, the cost to maintain proprietary DMA platforms is becoming untenable for many firms. This has led to a new breed of service providers, offering broker-neutral solutions that are built for both speed and cross-market access. Direct market access allows retail investors to buy and sell financial instruments directly over the stock exchange by eliminating intermediaries such as brokerage firms. Here, they have direct access to the electronic order book, which contains the details of all the orders traders place.

What’s the difference between low latency and ultra-low latency direct market access?

With DMA, traders can benefit from tighter spreads as they are directly connected to the market. ECN brokers aggregate prices from multiple liquidity providers, ensuring competitive spreads and minimal slippage. This cost-saving advantage is particularly crucial for high-frequency traders or those who execute large volume trades. When it comes to trading in the financial markets, having access to accurate and reliable information is paramount. Understanding how ECN brokers work can empower traders with the ability to make more informed decisions and execute trades with greater precision. In this section, we will delve deeper into the world of ECN brokers, exploring their key features, advantages, and tips for choosing the right one for your trading needs.

The core of an exchange is its matching engine — the technology that matches a buy order and a sell order against a bid and ask price to generate a trade. This trade price (LTP) and open orders are streamed to brokers who use this to feed their trading platforms (marketwatch, charts, etc.). Under the SaaS model, buy-side players continue to use brokers (since they are not typically members of an exchange), but not for the technology component, as the DMA platform is broker-neutral. And brokers themselves no longer need to build and maintain their own DMA-based trading platforms, which can siphon away resources from the parts of their business that really make a difference with clients. Utilising a SaaS model enables them to mutualise costs and create business flexibility. As explained, direct market access is a technology that gives traders and investors a more complete access to the financial market.

DMA offers access to a wide range of financial markets, including equities, commodities, and forex, allowing traders to diversify their portfolios. In direct market access, you have access to these market makers and you can select the one with the best price. Because of how competitive it is, some of the market makers could also pay you some money for adding liquidity into their platforms. Traders using L2 Dealer can trade CFDs on shares or Forex and benefit from Level 1 and Level 2 market access. In contrast, Level 2 allows traders to see and interact directly with the exchange order book, giving them a better understanding of market sentiment and underlying liquidity. L2 Dealer also features in-platform news and analysis, customisable alerts, and real-time charts, making it a comprehensive platform for experienced traders looking for DMA capabilities.

DMA traders can see the orders directly on the books of the exchange that they are dealing with and are charged on a commission basis instead of via the spread. It’s a way of placing trades that offers more flexibility and transparency than traditional dealing (which is usually referred to as OTC, or over-the-counter). For instance, let’s say you are trading forex and you want to protect yourself from potential losses. By setting a stop-loss order, you can automatically exit the trade if the price moves against you beyond a certain threshold. Forex nano accounts allow you to trade from as low as 0.001 lots or 100 units of currency.

- When choosing a DMA broker, it is important to consider factors such as minimum deposits, market coverage, trading platform, fees, and regulation.

- Another benefit to consider with the SaaS model is the ability it gives firms to fail fast.

- Trading with direct market access opens up a world of possibilities for traders, allowing them to employ various strategies tailored to their trading preferences and goals.

- Direct Market Access (DMA) brokers give traders direct market access to exchange order books for better pricing and execution of futures, options and CFDs.

- This article delves into the intricacies of DMA, its benefits, and its implications for traders seeking a more hands-on approach to their trading strategies.

- The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

- The CFD provider will base the price of a CFD on the price of the underlying financial instrument in the direct market.

In this article, we examine some of the best DMA brokers available today for those seeking direct access to financial markets. We consider factors such as minimum deposit, platform features, range of markets, and more. Contracts for difference (CFDs) are trades between a CFD provider and a client. A CFD does not give ownership of the underlying financial instrument to the client.

The fee structure and commissions charged by these brokers can be much higher than online and direct-access brokers. Many of these brokerages have physical offices that investors and traders can visit to sit down and speak with a financial professional. They also come with proprietary products, including ETFs, mutual funds, insurance, and credit products that investors may want to consider adding to their portfolios. DMA allows you to trade on underlying market prices and depth, but what you’ll actually receive on placing a trade is a CFD from your CFD provider. In contrast, another trader using DMA implements a comprehensive risk management strategy.

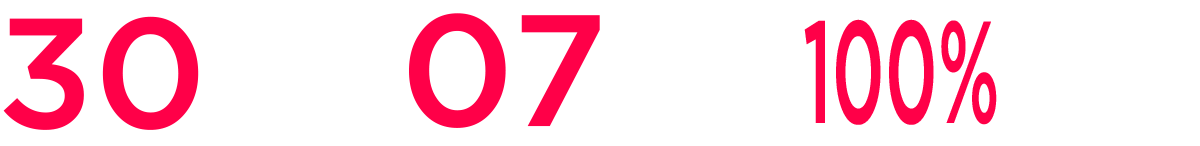

This cautious approach can help mitigate potential losses while you gain experience. The technology behind DMA is sophisticated, ensuring that orders are transmitted swiftly and securely. This direct connection reduces latency, the delay between order submission and execution, which is crucial in fast-paced trading environments. Swift and consistent execution to enable our clients to make the most of market opportunities. 100% DMA routes; all of your orders directed to the best provider to maximize your benefits and decrease your costs. For faster execution and the best pricing, Advanced Markets maintains a solid infrastructure and the technology and experience to deliver results.

This means traders can place buy and sell orders directly on the market, without the need for a broker to act as an intermediary. Here is an example – On April 20th, 2020, Crude Oil prices closed at a negative price. The brokerage industry in India lost upwards of Rs 330 crores in client defaults. If there were no brokerage firms, this loss of Rs 330 crores instead of being across multiple brokers would have been on Multi commodity exchange (MCX). While MCX has networth of over Rs 1500 crores, it may not be all in liquid instruments, hence meaning that this incident could have put the exchange and hence everyone else who trades on MCX at risk.

To illustrate the benefits of DMA, let’s consider a case study in forex trading. In traditional forex trading, brokers act as market makers, meaning they take the opposite side of their clients’ trades. This can result in potential conflicts of interest, as brokers may have an incentive to manipulate prices to their advantage.