cash advance payday loans

Whenever confronted with delinquency, step one is getting in touch with the lender timely to discuss repayment alternatives

Up on lost mortgage repayments, the risk of foreclosures looms as a critical hazard, potentially ultimately causing the increasing loss of the newest borrower’s home. Foreclosed house offer no-brainer opportunities, but having your domestic foreclosed is just one of the poor-instance scenarios inside homeownership.

Property foreclosure legal proceeding usually initiate as much as 120 those days due, with loan providers opening the procedure if the money are still outstanding. This may possess really serious effects, plus negatively affecting enough time-identity economic balance. Immediately after foreclosures is initiated, it may be difficult to contrary the process, so it is essential consumers to communicate through its loan providers and you may talk about choices to prevent so it consequences.

Property foreclosure results in the increased loss of the house and you will brings about long-lasting impacts, instance complications obtaining coming funds, prospective personal bankruptcy, and you can emotional stress. Looking to guidance off financial experts, understanding rights, and you may keeping discover telecommunications which have loan providers are crucial methods to browse the reasons of foreclosures and you may manage an individual’s economic really-becoming.

Foreclosures Timeline

Loan providers could possibly get intensify step from the delivering a consult letter shortly after around three missed costs, highlighting the newest urgency to handle a home loan payment delinquency. If the payments continue to be outstanding following the a good forbearance months, the foreclosure techniques get start, causing potential judge implications and risk of losing a person’s home. This type of property foreclosure legal proceeding usually start just after 120 times of overlooked home loan repayments, establishing a life threatening reason for the fresh foreclosure schedule.

You to main point here to remember: based on government law (specifically this new Dodd-Frank Act), foreclosure may start through to the 120-big date threshold. This can happen when your borrower violated a because of-on-income term, we.elizabeth. the mortgage was not paid down with marketing proceeds, or perhaps the lender is joining a property foreclosure action from the yet another lienholder. This new endurance could be loans Uriah AL longer than 120 months if you file a loss of profits minimization application, such as requesting financing amendment.

Sophistication Months

During the sophistication several months to own mortgage repayments, consumers is target any overlooked payments ahead of more serious procedures is actually caused. This period usually range regarding fifteen to help you thirty days at night due date. In the event the a mortgage fee is not produced contained in this schedule, it will adversely affect the debtor.

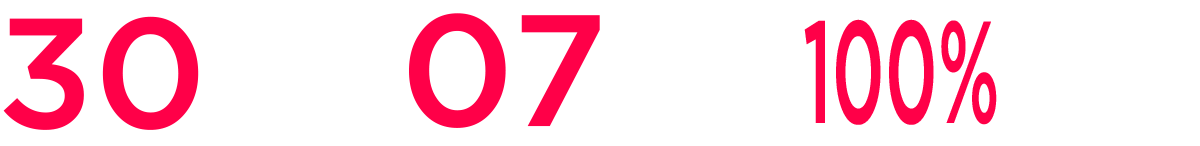

30, ninety, and you will 120 Weeks Late

a month: As mentioned, credit reporting agencies will get report a good mortgage payments just after only thirty day period, making this a significant time to question timely repayments and help fix the issue that it does not get progressively even worse.

ninety days: Even when foreclosure proceedings typically initiate doing 120 those times owed, lenders usually procedure delinquency notices around 90 days just after an effective overlooked payment, proclaiming intention so you’re able to foreclose is actually money aren’t raised to help you date. Also, more late costs are billed immediately following 60 days, improving the borrower’s financial weight.

120 weeks: When a borrower is located at 120 days of overlooked repayments, the new foreclosure processes is usually started, leading to potential legal action together with likelihood of shedding new domestic. It requires from around two months for some years immediately after such 120 months for the latest property foreclosure purchases to be finished.

How exactly to Catch-up to the Costs

Property owners can catch up to your missed payments like they may be able pay home financing regarding very early that have even more money. Alternatives for example forbearance, cost preparations, otherwise loan adjustment also provide avenues to deal with the new an excellent harmony.

And make a lump sum to afford overdue amount was a direct approach to taking the home loan newest. In the event the a lump sum payment isnt possible, establishing a structured fees plan to the financial will help during the slowly paying down the brand new overlooked costs more than a decided-upon months.

Dependent on your state in addition to readily available capital at a given day, Disaster Home loan Direction are offered; although not, home owners can not count on so it due to these types of motion.